Arbitrum’s initial governance plan causes $1B debate

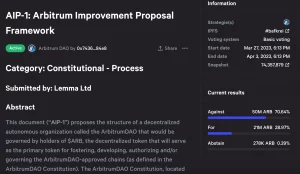

A plan to pay the Arbitrum Foundation with 750 million ARB tokens, or roughly $1 billion, sparked uproar in the ARB community over the weekend, despite the Foundation’s announcement that it was only ratifying an already-made decision.

A few days after the layer-2 protocol airdropped its governance token, a disagreement arises.

According to the AIP-1 plan for Arbitrum’s DAO, the 750 million tokens would be used to fund “Special Awards, reimbursement of relevant service providers […], and ongoing administrative and operational expenditures of The Arbitrum Foundation.”

At the time of this writing, greater than 70% of token holders oppose the proposal.

Following criticism from community members, the Foundation stated in a forum post on April 2 that AIP-1 was not a proposal but rather a ratification. It was also mentioned that a portion of the tokens had been exchanged for stablecoins. In other words, its multibillion-dollar budget and allocations would not be subject to a governance mechanism on the blockchain.

The Arbitrum Foundation asserts that the symbolic first governance effort failed due to communication issues and “obviously not communicated appropriately” decisions:

“One of the mistakes in the drafting of AIP-1 was a failure to note at the outset that this proposal was intended to act as a ratification of the initial setup of both the Arbitrum DAO and the Foundation that has been created to serve the DAO. […] the point of AIP-1 was to inform the community of all of the decisions that were made in advance.”

Members of the community pointed out on the governance forum that Arbitrum’s team “has been dumping tokens that were initially communicated to the community as locked tokens,” claiming that “all tokenomics pages show only user airdrop + DAO airdrop tokens as unlocked,” with the remaining “tokens to unlock in March 2024.”

Others emphasized that under U.S. securities regulations, the expected sale would be deemed fraud and that U.S. residents who purchased ARB tokens or claimed the airdrop “are eligible for legal remedies.”

A community member stated, “I will pursue this with my attorneys and expect to file a securities fraud lawsuit within the next few days.” […] The Arbitrum Foundation is advised to immediately halt all illegal sales of the token that are being conducted without authorization and in violation of the law.

The layer-2 analytics website L2Beat reports that Arbitrum’s blockchain controls 65% of the Ethereum layer-2 market share. On March 23, the highly anticipated debut and airdrop of its native governance token occurred, and hundreds of thousands of qualified users and DAOs claimed ARBs.

It was stated that the airdrop claim portal crashed immediately after its introduction due to overwhelming consumer demand.