The number of Bitcoin Futures and perpetual contracts on bitcoin is at an all-time high, and traders are paying more to bet on more price drops in a bearish market.

The Bitcoin Futures market is now bigger than ever, and investors seem to be putting more money on the price going down.

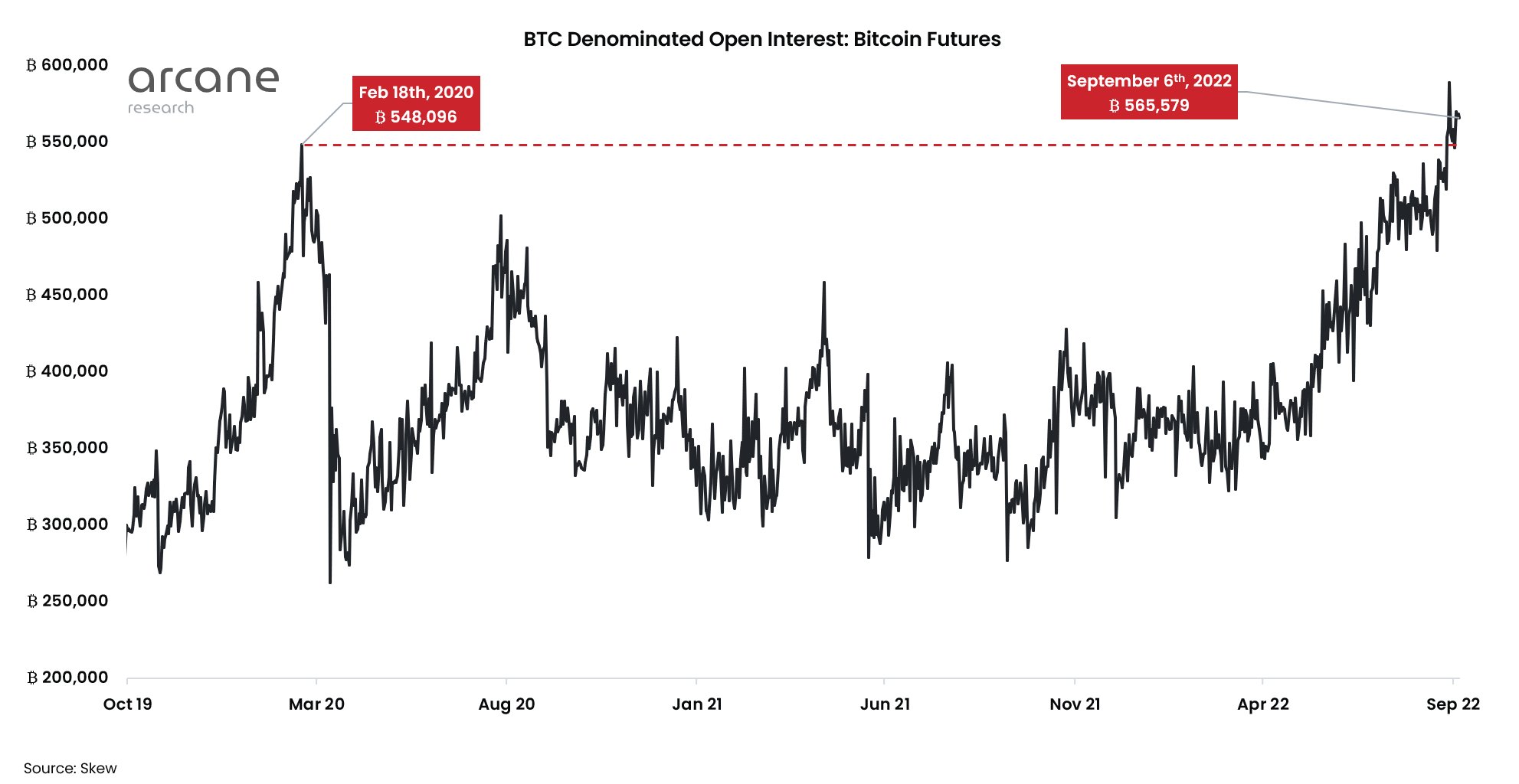

According to Arcane Research, the open interest (OI) in futures and perpetual (futures with no end date) tied to the largest cryptocurrency has reached a new record high of 565,579 BTC ($10.6 billion). This is more than the previous record high of 548,096 BTC, which was reached in February 2020. The data covers positions on traditional commodities exchanges such as CME as well as crypto exchanges like Binance and Bybit.

Open interest is the number of contracts that are still being worked on. Even though an increase in open interest shows that more money is coming into the market, it doesn’t tell us much about how the market is positioned.

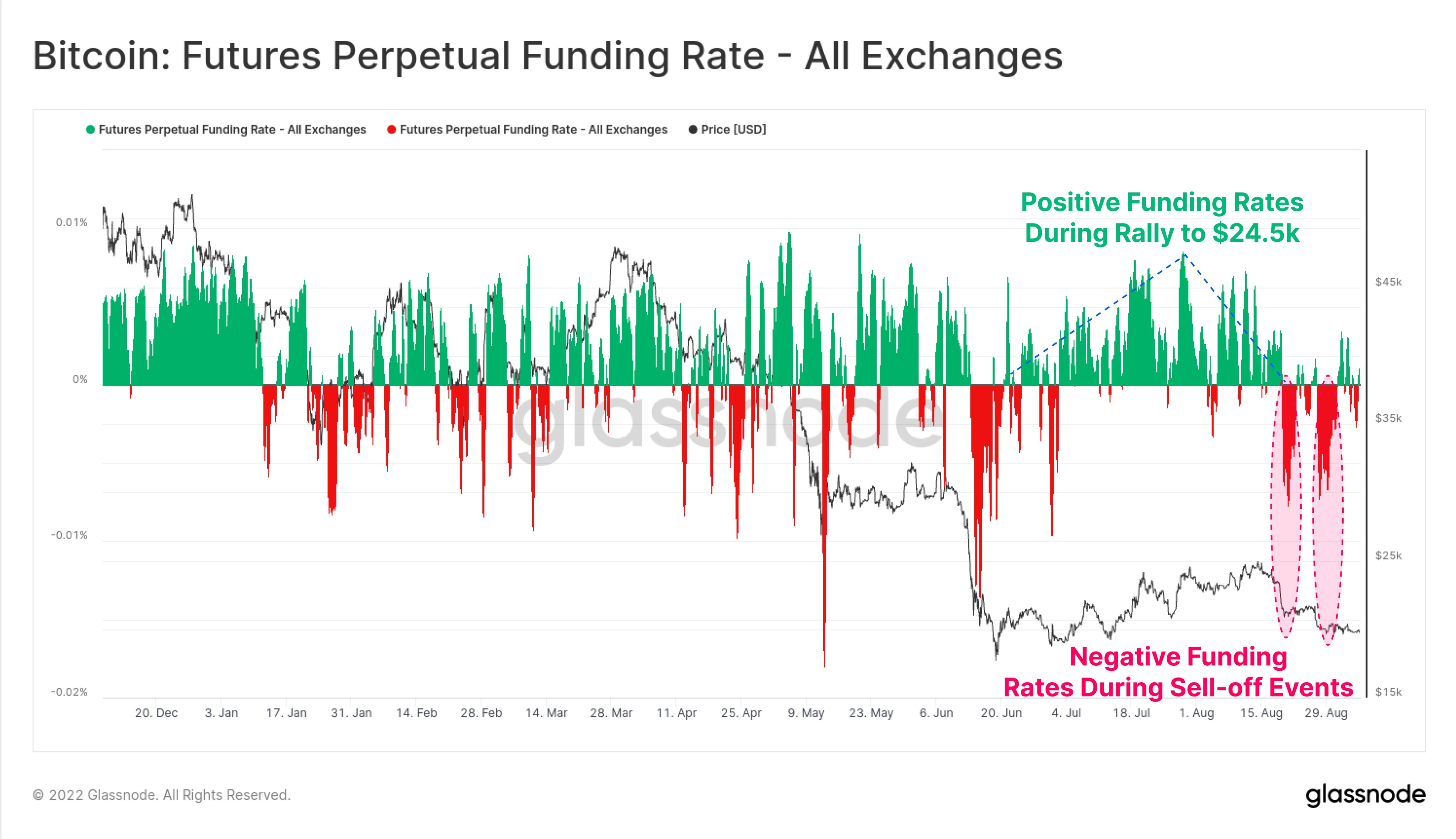

So, traders often look at open interest along with other metrics like futures basis, which is the difference between prices on futures markets and spot markets, and funding rates, which show how much it costs to hold bullish or bearish positions. When the funding rates are negative, the market is more likely to go down.

With bitcoin, it seems to be the other way around. “Open interest is always net neutral at the exchange level, but shorts [bearish trades] are definitely the aggressor now,” said Vetle Lunde, a research analyst at Arcane.

Since the middle of August, Bitcoin short-term futures on major exchanges like the Chicago Mercantile Exchange (CME) and Binance have been trading at a discount to the spot price. This shows that bearish flows are happening.

Early this month, data from derivatives research firm Skew showed that the annualized discount on CME’s one-month futures fell to 10%. Most people see the CME as a stand-in for institutional activity.

The CME basis seems to have gone negative because U.S.-based exchange-traded funds (ETFs) that invest in CME-listed bitcoin futures are selling their positions.

“The month was bad for U.S. BTC ETFs, which caused the net BTC exposure to drop by 2,879 BTC. This makes August the second-worst month for U.S. ETFs since they started in October, “In a report that came out on September 5, Lunde said:

Since mid-August, Bitcoin’s perpetual funding rates, which are charged every eight hours, have mostly stayed negative. This is a sign that shorts are paying longs to keep their bearish position in case the market keeps going down.

According to data from CoinDesk, Bitcoin hit a two-month low of $18,558 early Wednesday.

The increasing leverage could bring more volatility to the market. “I’m very worried about the OI trend going up. From what we know about the past, this level of debt in the market can’t last “Lunde said.