BRICS to Destroy Dollar, Western Dominance? Not yet!

A Bid to End Dollar’s Dominance

After the Pound Sterling lost value during WWI and WWII, the U.S. dollar became the world’s reserve currency in 1944. With the Bretton Woods Agreement, the fall of the Pound Sterling made it possible for the dollar to rule the world’s markets while Franklin D. Roosevelt was in charge.

But now, developing countries want to work together to end the dollar’s dominance and weaken the West’s financial power. On the other hand, compared to other currencies on the market, the dollar’s value is slowly decreasing.

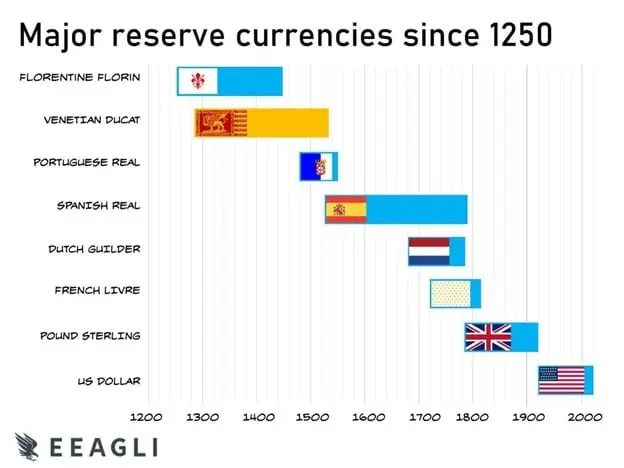

Still, this might be a short-term problem rather than a long-term one. The timeline below shows how many different currencies ruled the world before the dollar took over.

Will BRICS Currency Replace U.S. Dollar Soon?

On a global scale, BRICS might be unable to replace the U.S. dollar soon. In simple terms, money only changes hands worldwide when both parties have something of value to offer.

If one party doesn’t want a new currency and would rather keep using the dollar, it could make it harder for BRICS to do business.

If the other country (one that isn’t a member of BRICS) likes the new currency, it could lose some of its value. It will take a lot of time for new money to gain value, and this might not happen in a short amount of time.

On the other hand, the countries in the East are less united than those in the West. India and China are at odds with each other, and political turmoil keeps erupting between the two countries.

For example, in 1985, Afghanistan, Bangladesh, Bhutan, India, the Maldives, Nepal, Pakistan, Sri Lanka, and Nepal formed the South Asian Association for Regional Cooperation (SAARC). “Deeper Integration for Peace and Prosperity” is the slogan of SAACR.

India and Pakistan, on the other hand, have been at a crossroads for more than a decade, and SAARC shows that. Sri Lanka’s economy is in bad shape, and Afghanistan is still at war. Maldives went through an economic crisis last year, and the effects are still being felt. So, SAARC is now saying the opposite of what it was supposed to say initially.

In conclusion, there is no guarantee that the BRICS countries will work together tomorrow as they do today. “Unity first, policy second” is something that countries in the East need to work hard on. Until then, the U.S. dollar will still be in high demand worldwide, despite some bad things.