DAI, USDD stablecoins suffer from Circle’s USDC volatility

The stablecoin ecosystem had an immediate impact when USD Coin decoupled from the U.S. dollar as a result of a subsequent sell-off after Silicon Valley Bank’s (SVB) refusal to approve $3.3 billion of Circle’s $40 million transfer request.

Due to USDC’s collateral effect, the majority of stablecoin ecosystems decoupled from the U.S. currency.

Dai, a stablecoin launched by MakerDAO, had a 7.4% loss in value as a result of USDC’s decoupling.

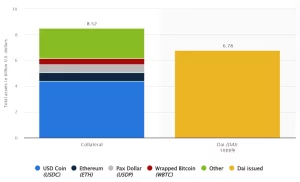

Statista data indicates that as of June 2022, $6.78 billion worth of DAI supply was backed by $8.52 billion worth of cryptocurrencies.

The USDC represented 51.87 percent of DAI’s $4.42 billion in collateral.

Other popular cryptocurrencies are Ether and Pax Dollar (USDP), with respective market capitalizations of $0.66 billion and $0.61 billion.

As a consequence, DAI decoupled from the dollar and briefly approached $0.897.

As demonstrated below, the stablecoin has returned to trading around the $0.92 level at the time of writing.

Due to negative market sentiments, Dollar Digital (USDD), a stablecoin produced by Tron, and fractional-algorithm stablecoin Frax (FRAX) experienced a similar fate.

The USDD reacted to the USDC decline by falling about 7.5% to $0.925, while FRAX fell even more to $0.885.

Several prominent cryptocurrencies, such as Tether and Binance USD, continue to be pegged to the U.S. dollar at a 1:1 ratio.

The whole depegging affair began when Circle disclosed that $3.3 billion of its funds were not withdrawn by SVB.

The California Department of Financial Protection and Innovation closed SVB for unknown reasons.

To preserve insured accounts, however, the California regulator named the Federal Deposit Insurance Corporation as receiver.