MicroStrategy Chairman Initiates $216 Million Stock Option Sale for Bitcoin Acquisition

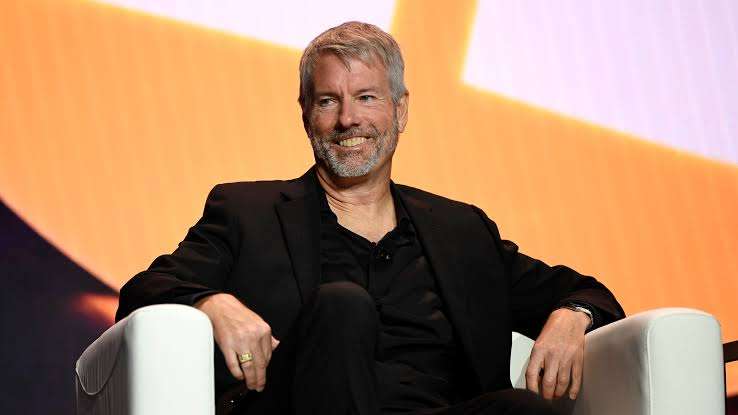

On Tuesday, the executive chairman of MicroStrategy (MSTR), Michael Saylor, commenced the sale of company stock options valued at $216 million, according to a regulatory filing with the U.S. Securities and Exchange Commission.

Saylor proposed the sale of 310,000 stock option awards that were granted in 2014 and are set to expire in April, according to the document.

Saylor stated, subject to a minimum price condition, that he intends to sell 5,000 shares per trading day for the next four months during Microstrategy’s third-quarter earnings call.

Initially disclosed in his 10-Q filing for that quarter, it stated that he has until April 26 to sell a maximum of 400,000 shares of his vested options.

Saylor stated during the call, “By exercising this option, I will be able to fulfill personal obligations and add additional bitcoin (BTC) to my account.”

“I maintain a positive outlook regarding MicroStrategy’s future and would like to emphasize that my equity interest in the organization will remain substantial even after these transactions.”

The largest corporate holder of Bitcoin, with approximately 189,000 BTC in its treasury following the most recent purchase in December and valued at roughly $8.5 billion at present prices, is MicroStrategy.

MicroStrategy shares increased 8.5% on Tuesday, bucking the market decline for cryptocurrency-focused equities.

Since midnight UTC, Bitcoin’s price has increased, and it is currently trading at around $45,000 at the time of writing.

Market participants anticipate that the U.S. Securities and Exchange Commission will approve a spot bitcoin exchange-traded fund (ETF) in the coming weeks, increasing the asset’s potential exposure to retail and institutional investors.