Documents obtained from reuteur reveals that the India SEBI has

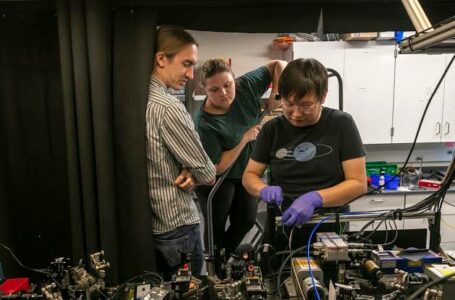

Harvard physicists have developed the longest secure quantum network, spanning

Aiden Pleterski has been charged with fraud and money laundering

Pink Drainer, responsible for stealing $75M in crypto from around 20,000 victims, have announced the

Documents obtained from reuteur reveals that the India SEBI has recommended that multiple regulators supervise

Harvard physicists have developed the longest secure quantum network, spanning 22 miles using existing fiber-optic

Aiden Pleterski has been charged with fraud and money laundering by Canadian police, along with

The attacker utilized flash loans to manipulate the bonding curve contracts, causing financial harm. An

Microsoft will preview its new Cobalt 100 processors to the public at its upcoming Build

Tether, the TON Foundation, and Oobit have teamed up to create an encrypted payment method

The announcement of Bonk's listing on Bithumb, South Korea's second-largest cryptocurrency exchange, led to a