Nigerian Interpol recently collaborated with cybersecurity experts and local intelligence agencies to address the increasing cybercrime rate.

The Nigerian Interpol convened with cybersecurity specialists and other members of the local intelligence community to discuss strategies for combating the nation’s surging cybercrime epidemic.

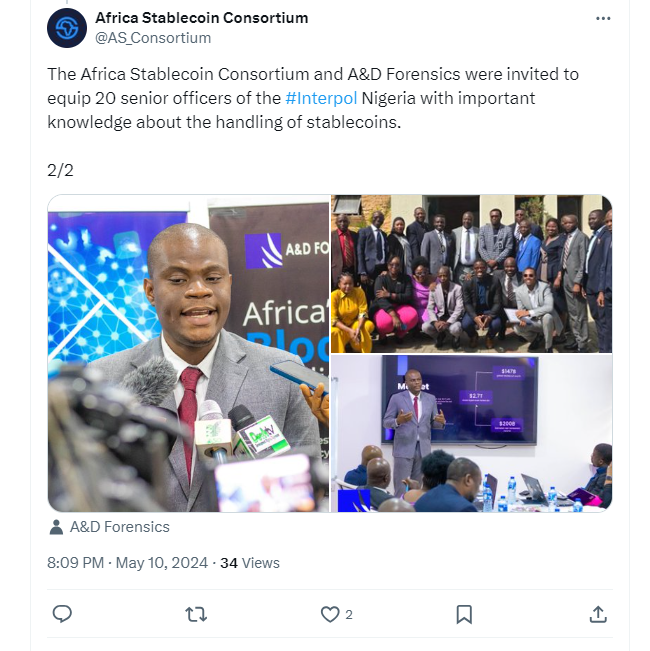

According to reports, the purpose of the brainstorming, which was held in Abuja as part of the training platform run by A&D Forensics in collaboration with the Africa Stablecoin Consortium, was to put the Nigerian Interpol in a better position to combat crimes involving virtual assets, especially stablecoins.

The training session’s goal, according to blockchain expert Chioma Onyekelu, was to equip the Nigerian Interpol agents with the knowledge and abilities to use blockchain intelligence and analysis in order to find and apprehend cybercriminals engaged in cryptocurrency transactions, particularly those involving Bitcoin and stablecoins.

Cybercrime has advanced beyond the use of fiat money, with criminals increasingly utilizing virtual assets as a means of committing a variety of online crimes, according to Onyekelu. Through focused training sessions, Nigeria’s Interpol can better respond to requests from foreign partners on cybercrime.

With Nigeria’s increasing engagement in virtual asset exchanges, Onyekelu clarified that officers will be able to combat cybercrimes involving virtual assets—especially stablecoins—thanks to the training.

Adedeji Owonibi, senior partner at A&D Forensics, told the media that the training was essential because of the nation’s growing cybercrime trends. He made the observation that,

“A significant gap exists between the evolving cybercrimes and the capabilities of law enforcement agencies in Nigeria. As responsible corporate citizens, we recognized the need to bridge this gap and support our law enforcement agencies in staying updated and effectively combating cybercrimes.”

Owonibi addressed the debates surrounding Levy’s recent cybersecurity introduction by asserting that, despite its contentious nature, the government has the authority to make decisions that impact national security and stressed the importance of prioritizing the country’s security interests.

On Monday, the Central Bank of Nigeria (CBN) will administer the National Cybersecurity Fund under the supervision of the Office of the National Security Adviser (ONSA). The CBN ordered banks and other payment service providers to start withholding 0.5% of the entire value of electronic transactions.

The Securities and Exchange Commission (SEC) of Nigeria is taking action against cryptocurrencies, outlawing peer-to-peer exchanges that use the naira, and indicating a dramatic change in the country’s regulatory landscape.

As part of its economic reformation efforts, the International Monetary Fund (IMF) has advised Nigeria to embrace the adoption of cryptocurrencies by granting licenses to international cryptocurrency exchanges.