NYCB stocks fell 42% before rebounding on news of a $1 billion investment led by former Treasury Secretary Steven Mnuchin.

Wednesday saw a rollercoaster ride for investors in the beleaguered New York Community Bancorp (NYCB) as the bank’s shares fell 42% before rising once more on the announcement of a $1 billion lifeline from investors.

NYCB, an American regional bank with over $100 billion in assets, acquired the once-crypto-friendly Signature Bank after its failure in March 2023. However, with Q4’s lower-than-expected financial performance a cut in quarterly payouts and concerns about possible losses from underperforming loans in the commercial real estate industry, NYCB stocks has entered a tumultuous phase.

On March 6, NYCB stocks dropped more than 42% to $1.76 before trading was suspended due to pending news. After announcing a strategic equity investment of more than $1 billion allegedly intended to “restore investor confidence,” trading resumed a few hours later and shares immediately started to rise. In after-hours trading share prices spiked above $4 before dropping to $3.40.

Leading the capital injection was former Treasury Secretary and new NYCB board member Steven Mnuchin. “Mnuchin stated that the bank now has sufficient capital, with over $1 billion invested to increase reserves in the future to align with or exceed the coverage ratio of NYCB’s large bank peers.”

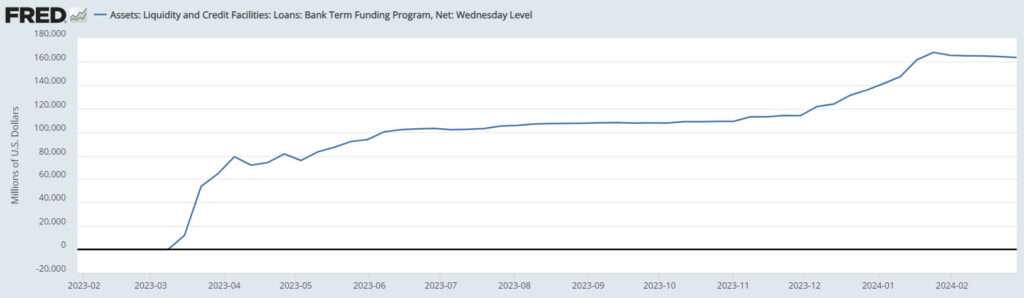

A week before the financial bailout program of the Federal Reserve was due to expire on March 11, NYCB stocks faced an extremely turbulent day. According to the St. Louis Fed, the U.S central bank has provided $164 billion to troubled banks since its inception.

Multiple prominent bank collapses prompted the introduction of the Bank Term Funding Program (BTFP) in March 2023. Its objective was to provide “eligible depository institutions” with more funding in order to ensure that banks could satisfy the needs of all of their depositors.

Bitcoin values increased by 40% when the BTFP was introduced in March 2023, during the US banking crisis and fallout from Silicon Valley Bank and Signature Bank failures. Balaji Srinivasan, an author and angel investor commented on the banking crisis on March 7, drawing parallels to the 2008 financial disaster caused by banks.

“It’s just like 2008, where everyone was told the mortgage-backed securities were AAA. Except this time the new toxic waste is Treasuries themselves.”