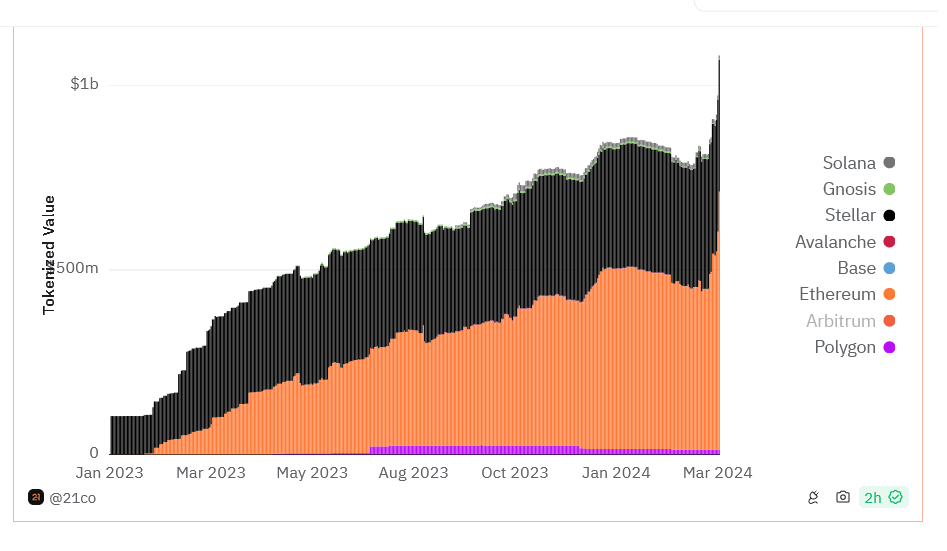

Tokenized US Treasurys valued at over $1 billion are now spread across various blockchains including Ethereum, Polygon, and Solana.

As a result of the recent establishment of the BlackRock USD Institutional Digital Liquidity Fund, there are currently more than $1 billion worth of United States Treasury distributed among various blockchains, including Ethereum, Polygon and Solana.

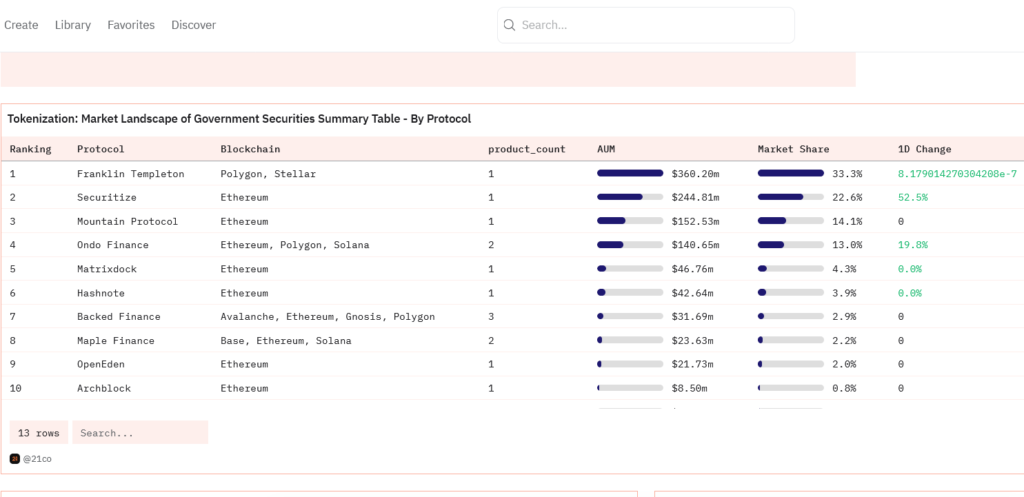

BlackRock introduced a product on Ethereum on March 20 under the ticker symbol “BUIDL,” which currently has a market cap of 244.8 million dollars.

US Treasury Tokenized

Etherscan reports that during the week, four transactions to the fund to the tune of $95 million contributed to the fund, elevating it to the position of the second-largest tokenized government securities fund.

The data that the parent company of 21Shares produced on a Dune Analytics dashboard indicates that BUIDL is now only behind Franklin Templeton’s Franklin OnChain U.S. Government Money Fund (FOBXX), which has been in existence for eleven months and currently holds a total of $360.2 million in US Treasury.

The screen shows that 17 different categories have tokenized 1.08 billion dollars’ worth of US Treasury securities. Ondo Finance, a real-world asset tokenization company, made the most recent deposit of $79.3 million into BlackRock’s fund.

This transaction will facilitate swift settlements for Ondo Finance’s U.S. Treasury-backed token, known as OUSG. Etherscan’s information indicates that the company deposited a total of $95 million in four different transactions.

According to Tom Wan, a research strategist at 21.co., who revealed this information in a post on March 27, Ondo Finance currently has a 38% holding in BUIDL.

BUIDL not only pays daily accrued dividends directly to investors every month, but it also fixes its price at a 1:1 ratio with the US dollar. The Securitize protocol introduced it on Ethereum.

Given the present high-interest rate climate, 21. co-identified tokenized government treasuries as more appealing from a risk and return perspective than stablecoin yields.

The company’s Dune dashboard reflected this.One of the most recent statements made by BlackRock CEO Larry Fink was that blockchain tokenization, which Boston Consulting Group forecasts could become a market worth $16 trillion by the year 2030, has the potential to make financial markets more efficient.

In addition to US Treasury, which are just one piece of the pie, tokenization is also possible for equities, real estate and a wide range of other assets.

Additionally, Ethereum is responsible for 700 million dollars worth of all real-world assets (RWA) tokenized on the blockchain.

Franklin Templeton tokenizes FOBXX on Stellar and Polygon, which hold the second and third most significant market shares of tokenized goods, respectively, with $358 million and $13 million.

Ondo Finance, Backed Finance, Matrixdock, Maple Finance and Swarm are some blockchain-native companies currently functioning in the field.

WisdomTree is another significant asset management business that is tokenizing RWAs.