ProShares plans to launch leveraged and inverse Bitcoin ETFs which include Plus, Ultra, UltraShort, Short, and ShortPlus Bitcoin ETFs.

Amid the first few days of spot Bitcoin ETF trading on local stock exchanges, ProShares, a leading issuer of exchange-traded funds (ETFs) in the United States, is planning to launch numerous Bitcoin ETFs with indirect exposure to Bitcoin.

On January 16, It submitted a document to the United States Securities and Exchange Commission (SEC) stating their intention to establish leveraged and inverse Bitcoin exchange-traded funds (ETFs).

According to the daily performance of the Bloomberg Galaxy Bitcoin Index (BGCI), exchange-traded funds (ETFs) seek daily investment returns from variations in the price of Bitcoin, including rises and declines.

ProShares’ prospectuses expressly suggest the introduction of five new exchange-traded funds (ETFs) that are based on Bitcoin. These ETFs are the Plus Bitcoin ETF, Ultra Bitcoin ETF, UltraShort Bitcoin ETF, Short Bitcoin ETF, and ShortPlus Bitcoin ETF.

Both the ProShares Plus Bitcoin ETF and the ProShares Ultra Bitcoin ETF aim to achieve daily investment outcomes that are equivalent to a 1.5x and 2x gain, respectively, from the daily performance of the BGCI.

ProShares UltraShort Bitcoin ETF, ProShares Short Bitcoin ETF, and ProShares ShortPlus Bitcoin ETF are the other three funds that seek daily investment outcomes based on the inverse of the daily performance of the Bitcoin Global Commodity Index (BGCI).

These funds target investments with a daily performance of -2x, -1x, and -1.5x, respectively. ProShares emphasized in the filing that the funds do not directly short Bitcoin and said that it attempts to benefit from drops in the price of Bitcoin rather than outright shorting Bitcoin.

At the time of the filing, the price of bitcoin was approximately $43,000. With the introduction of spot Bitcoin exchange-traded funds in the United States, the price of Bitcoin experienced a dramatic decrease.

Some investors in the industry, such as Cathie Wood, CEO of ARK Invest, have previously forecasted that the market is likely to experience a short-term sell-off as a result of investors who are looking to cash out in response to positive news information.

On January 10, the United States Securities and Exchange Commission (SEC) approved the first ten spot Bitcoin exchange-traded funds (ETFs), and the first trades were conducted on January 11.

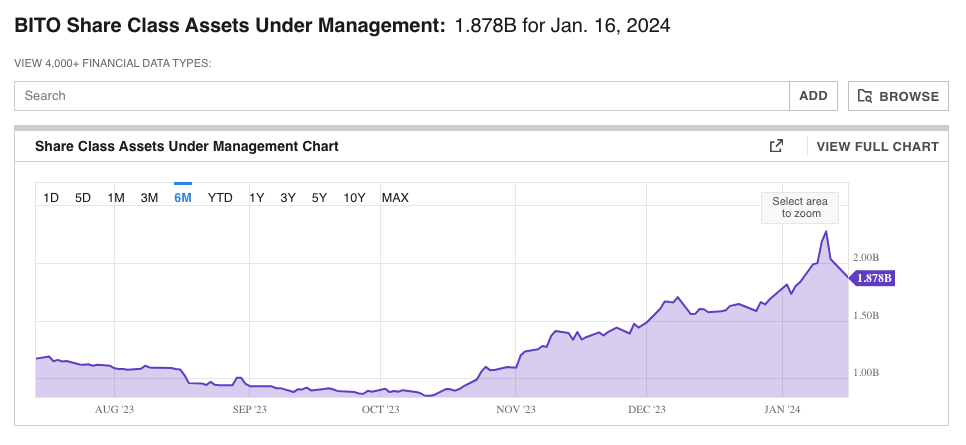

However, ProShares was not one of the issuers who produced the initial wave of spot Bitcoin exchange-traded funds (ETFs). The ProShares company has been concentrating on futures-based cryptocurrency exchange-traded funds (ETFs), and in October 2021, they launched one of the first Bitcoin futures-linked ETFs in the United States.

The Bitcoin Strategy Exchange-Traded Fund (BITO), which is the company’s flagship BTC futures-based product, has had substantial growth over the past few months. In January 2024, it briefly reached $2 billion in assets under management (AUM) for the first time.

The Ether Strategy ETF (EETH), the Bitcoin & Ether Market Cap Weight Strategy ETF (BETH), and the Bitcoin & Ether Equal Weight Strategy ETF (BETE) are the other ETFs that ProShares is now offering in addition to the Bitcoin Investment Trust (BITO).