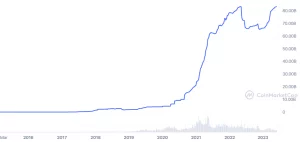

As its market dominance continues, the Tether stablecoin has reached a new all-time high (ATH) market capitalization of over $83 billion.

Other stablecoin issuers have struggled to stay afloat in the past year due to regulatory issues. The CEO of the cryptocurrency exchange Binance, Changpeng “CZ” Zhao, made the same point.

CZ drew attention to Binance USD, the stablecoin issued by Paxos under the Binance brand.

BUSD, a fully regulated stablecoin, was “capped” at $23 billion by the New York Department of Financial Services (NYDFS), according to the CEO of Binance.

Since then, USDT has experienced tremendous growth.

The NYDFS ordered Paxos to cease all new BUSD issuance in February, citing violations of security laws.

Competitors such as Circle-issued USD Coin and BUSD struggle to maintain market share as USDT reaches an ATH market cap.

The market capitalization of the second-largest stablecoin, USDC, is $28.8 billion, a difference of over $50 billion compared to USDT.

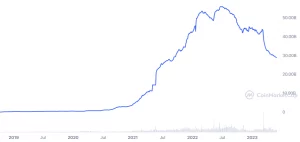

In context, USDC’s market dominance approached that of USDT at one point, with its market capitalization reaching a record high of $55.8 billion in June 2022.

The prolonged bear market of 2022 took its toll on both stablecoins, as their market capitalizations declined from their June 2022 peaks.

However, USDT has regained market dominance, while USDC’s market capitalization has decreased by nearly half.

The decline in the market share of other stablecoins is primarily attributable to regulatory scrutiny by United States regulators and the U.S. banking crisis.

After a ban on new BUSD minting for security violations, its market capitalization plummeted as users began exchanging their BUSD for other stablecoins.

Similarly, the major crisis for USDC was the collapse of Silicon Valley Bank, where the stablecoin issuer held approximately $3.3 billion in reserves.

This resulted in market panic and decoupling from the U.S. dollar.

Even though USDC regained its peg the following day, its market cap took a significant hit as many users converted their USDC to other stablecoins out of fear of a total crash.