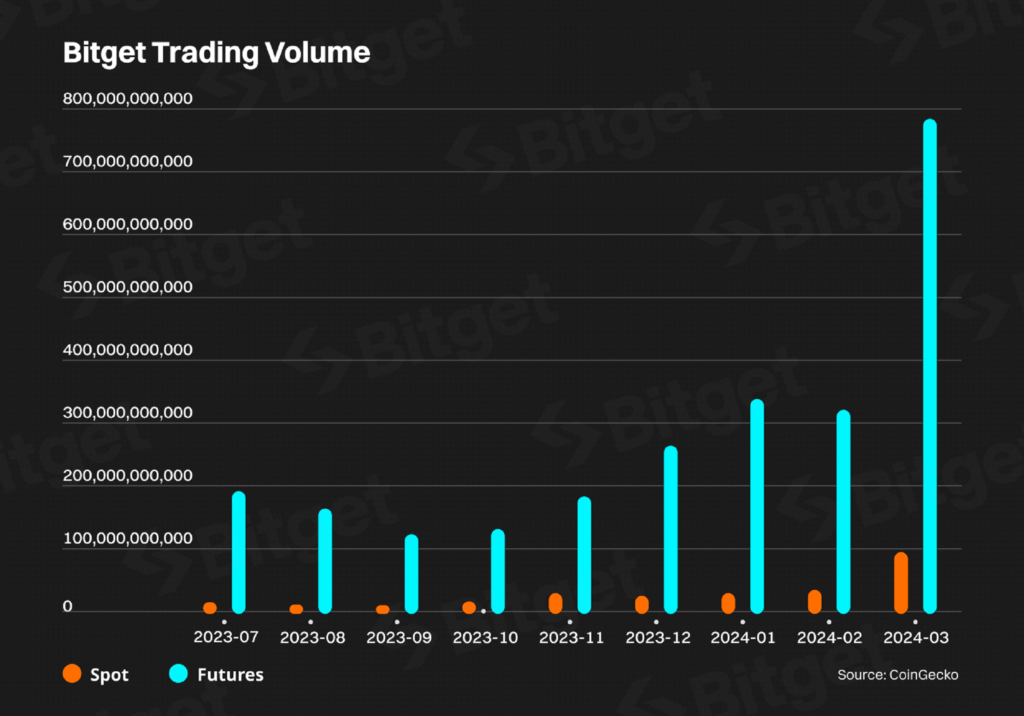

Bitget experienced substantial growth in futures and spot trading volumes in Q1 2024, exceeding $1.4T and $160B, respectively.

The volume of futures and spot trading on the cryptocurrency exchange Bitget surpassed $1.4 trillion and $160 billion in the first quarter, respectively.

This represents a significant increase from the volume of futures trading, which was $658 billion, and the volume of spot trading, which was $59 billion in the first quarter of 2023.

The trading platform and Web3 wallet of the exchange have a combined total of more than 25 million users, as stated in the report for the first quarter of 2024 that was released on April 11th.

The cryptocurrency exchange noted that the first quarter of 2024 was memorable for several significant occurrences in the cryptocurrency industry. They went on to say that February witnessed a vigorous market recovery, with Bitcoin reaching historic heights.

The buzz about Solana and the advancements in the artificial intelligence industries further underscored the market’s dynamic character. The Solana memecoin Dogwifhat (WIF) and the rollup utility token Altlayer (ALT) were two of the new tokens released on the exchange during the quarter, both of which saw gains of more than 100% after their debut.

During this same period, the native token of the exchange, known as BGB, rose to an all-time high of $1.38 and a gain of more than 400% year-over-year. Based on its BGB market cap figure, we estimate the exchange’s current worth to be $2.6 billion.

By the second quarter of this year, Bitget intends to launch an additional BWB token as the native coin of its Web3 wallet. An airdrop for the event is currently taking place.

CCData’s analysis shows that the exchange’s derivatives market share grew by approximately 2.5%., in March, marking the most significant growth among all centralized exchanges.

The researchers found that Binance, the leading derivatives exchange among the top 12 exchanges, held a market share of 47.0% of total volumes in March. Immediately after this, OKX came in second with a market share of 21.8%, while Bitget came in third with a dominance of 12.8%.

At the same time, the open interest of futures and derivatives on Binance, OKX, and Bitget increased by 37.8%, 34.7%, and 104%, respectively, in March 2024. CCData researchers made the following observations:

“Across the three exchanges analyzed, funding rates increased significantly to new highs before falling to levels at the beginning of the month, as the market sentiment remained positive with Bitcoin nearing its all-time high. The funding rate on the exchanges was positive throughout the month, increasing steadily, highlighting the leverage in the market.”

On January 16 Bitget committed $10m to support the launch of companies led by women in the Web3 and blockchain industries.

At the time, Bitget’s employees expressed their decision to “elevate blockchain knowledge and open up funding avenues for women.” This was in response to the fact that women-led cryptocurrency firms earned less than seven percent of the total venture capital funding.