BlackRock recently acquired memecoins and NFTs valued at over $40,000 through a newly discovered wallet linked to a tokenization fund.

The asset management company BlackRock now owns memecoins and nonfungible tokens (NFTs) worth at least $40.000 after onchain sleuths discovered one of BlackRock’s purported wallets connected to a new tokenization fund.

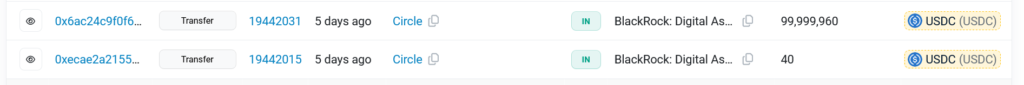

According to the data, a deposit of $100m worth of USD Coin (USDC) was placed on Ethereum on March 15.

This was precisely one day after the company issued a filing to provide its USD Institutional Digital Liquidity Fund through a partnership with Securitize, an asset tokenization firm based in San Francisco.

BlackRock Receives 40 Coins, 25 NFTs Anonymously

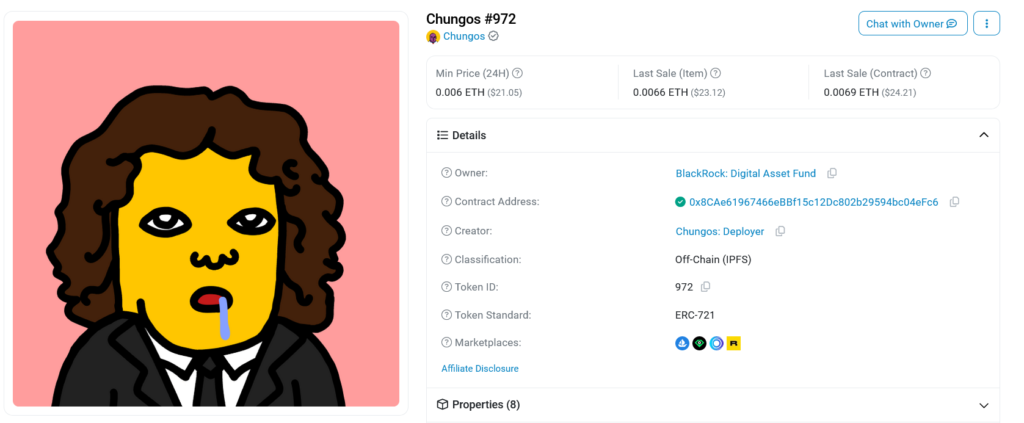

Since March 19, unidentified cryptocurrency users have contributed at least 40 coins and 25 non-fungible tokens (NFTs) to the BlackRock-label address.

These transactions include a CryptoDickbutts S3 NFT and a Bitcoin-based Ordinals Pepe (PEPE) coin. Also transferred to the $10 trillion asset manager were 500,000 unshETHing_Token (USH) tokens and 10,000 Realio Network (RIO) tokens.

The latter two tokens claimed the highest valuations, coming in at $13,755 and $11,600, respectively. It is interesting to note that the RIO token is a real-world asset tokenization currency.

According to CoinGecko, the token’s value has increased by 47%. Larry Fink’s company also received a significant amount of Mog Coin (Mog), VoldemortTrumpRobotnik-10Neko (ETHEREUM) and Shina Inu (SHI).

Among the most significant non-fungible tokens (NFTs) transmitted to asset management were Chungos and KaijuKingzar. Based on the data, it appears that the BlackRock address made its initial deposit of $200 on March 5th.

Once again, on March 15, the company made a test deposit of ten dollars, and then a few blocks later, according to Etherscan, the company deposited ninety-nine million dollars.

Fink, affiliated with BlackRock, has shifted his perspective on Bitcoin (BTC) and the blockchain business since 2017. In 2017, he referred to Bitcoin as an “index of money laundering.”

Since then, his perspectives have undergone significant shifts and in June 2023, BlackRock applied to an exchange-traded fund (ETF) to invest in spot Bitcoin.

Since its authorization, this ETF has been capturing some of the highest volumes in the entire ETF market. On Ethereum, Fink and BlackRock are exploring the possibility of tokenizing financial assets.

“We believe that the next step going forward will be the tokenization of financial assets,” Fink said in a recent interview with Bloomberg. “This means that every stock, every bond, and everything else will be on one general ledger and that will be the next step.”

There will be a ticker symbol for the BlackRock USD Institutional Digital Liquidity Fund, which will be “BUIDL.” It will make it possible for investors who meet the requirements to obtain yields in United States dollars by subscribing to the fund through Securitize Markets, LLC.