Chainlink (LINK) has significantly outperformed the general market correction, with its price rising over 6% in the last 24 hours and surpassing $17.50 for the first time in six weeks.

Chainlink, an Oracle service provider, has dissociated significantly from the general market correction, with a price increase of more than 6% over the course of the past twenty-four hours. The price of Chainlink (LINK) is trading closer to its important resistance level of $17.5, and its market cap has crossed the threshold of $10.1 billion at the time of this publication.

Additionally, the daily trading volume for LINK has increased by 80%, reaching a total of $858 million. This is a significant increase. LINK has emerged as a standout performer in the cryptocurrency market due to the insights provided by Santiment, an on-chain data provider.

Chainlink On-Chain Data Flashes Bullish Signal

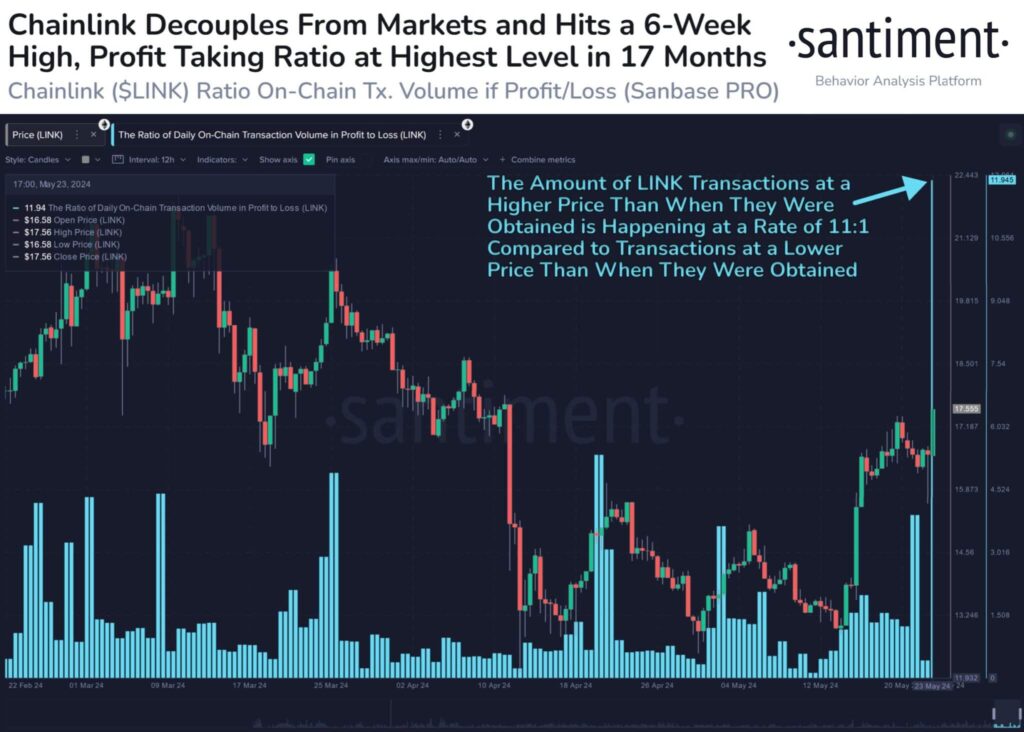

It has surpassed the $17.50 barrier for the first time in six weeks. Today’s on-chain analysis revealed a startling pattern: for every single LINK transaction recorded as a loss, eleven transactions showed a profit. This outstanding ratio marks the highest level since December 8, 2022, indicating a significant bullish sentiment surrounding the current price fluctuations concerning Chainlink.

As a result of a daily bearish order block, which is characterized by substantial market participants placing sell orders at $17.58 in the past, the present price of Chainlink is encountering resistance. In this case, the weekly resistance barrier is located at $16.48, which matches with this resistance level.

If buyers are unable to push the price of LINK higher, there is a possibility that a retracement will occur. The examination of the volume profile indication implies that a substantial volume of trades occurred around $14.62, which suggests that there may be potential support for the predicted correction. In the event that such scenarios occur, this is the case.

It is important to note that this level is in close alignment with the 61.8% Fibonacci retracement level, which presents an attractive accumulation zone for a possible second bullish run. The introduction of an Ethereum spot exchange-traded fund (ETF) has caused a recent surge in bullish mood, leading to an increase in optimism.

If Chainlink will signal an 18% rally to retest the $17.58 daily order block if it finds support around $14.62 before the end of the day. A successful breach of this resistance level could propel the price of Chainlink to $22, indicating a total gain of fifty percent amidst the accumulation of Chainlink whales.

This is a scenario that is quite hopeful.Although rigorous technical analysis and on-chain data support Chainlink’s potential, a weekly candlestick closure below $13.59 would nullify the bullish outlook by forming a lower low on a higher timeframe. An event of this nature could result in a 13% decrease in the price of LINK, which could bring it closer to a critical support level of around $11.80.

Furthermore, the data on the chain shows that Chainlink has also advanced. On May 18, there were 2,900 active addresses within the Chainlink network. On May 21, that number increased to 11,300. This is a considerable increase in the number of active addresses within the network. With this significant growth, it is clear that the Chainlink platform is in high demand.