DBS Bank is allegedly linked to a cryptocurrency wallet holding 170,000 Ether, valued at $650 million.

DBS Bank, a multinational banking and financial services organization, allegedly owns a cryptocurrency wallet containing approximately 170,000 Ether, estimated to be worth nearly $650 million.

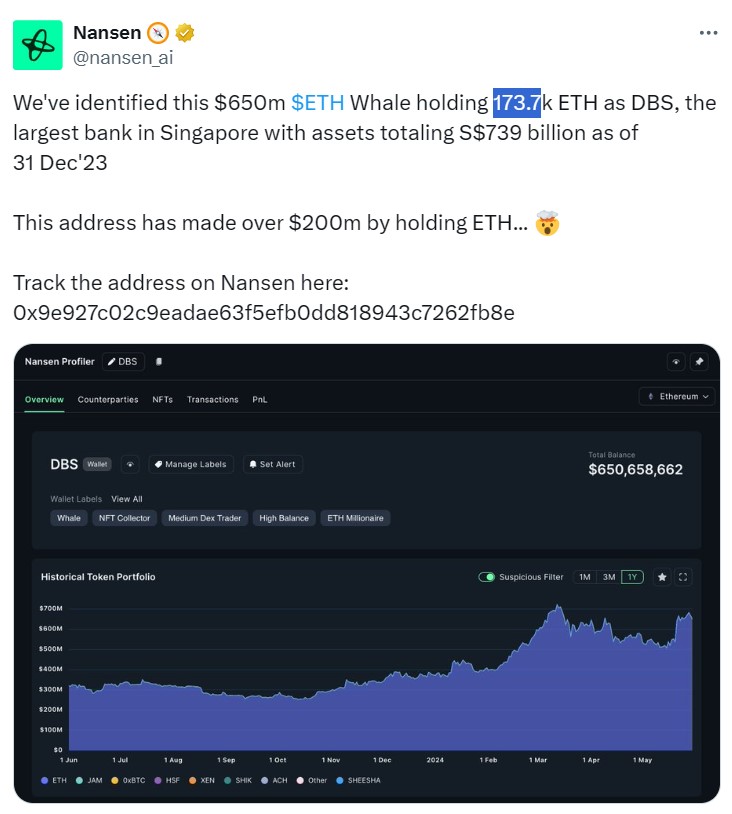

Nansen, a company that specializes in blockchain analysis, identified a possible Ethereum “whale” as the Singaporean financial institution on May 30. Nansen has determined that the whale in question is DBS, one of the most significant financial institutions in Singapore.

Nansen believes that by holding Ether, the cryptocurrency wallet has already generated a profit of two hundred million dollars. Some people have hypothesized that the ETH could have come from DBS Bank’s digital exchange for approved investors, even though the bank has not yet acknowledged whether or not it really belongs to them.

Rather than being assets owned by the bank, the ether that is stored in the wallet might be assets held on behalf of investors, as was pointed out by a member of the community.

In 2020, DBS Bank introduced a cryptocurrency trading and custody service, along with a platform for conducting security token offerings.

DBS Exchange announced at the time that it would not hold any assets, but instead provide custody services to investors. According to the bank’s statement, “DBS Bank, which is globally recognized for its custodial services, is the location where all digital assets are stored.”

During that time period, DBS also emphasized that it would provide support for key cryptocurrencies such as Bitcoin, Bitcoin Cash, Ethereum Classic, and ETH. Since its establishment, DBS Bank’s cryptocurrency business has achieved significant success.

According to DBS, the number of Bitcoin purchases made on the bank’s digital exchange increased by a factor of four in 2022. When compared to April 2022, the total number of deals in June 2022 increased by more than twofold.

DBS attributed the eighty percent increase in bitcoin trading in 2023 to the decline in the value of cryptocurrencies in 2022. In July 2023, DBS Bank introduced a digital yuan transaction tool and successfully completed its first transaction for corporate customers.

DBS Bank China, the debut of its e-CNY merchant solution, which enables enterprises to receive payments using the central bank digital currency (CBDC), DBS Bank China, the Japanese financial institution’s Chinese subsidiary, made the announcement.