Based on a filing made on Nov. 29 in a Delaware bankruptcy court, bankrupt crypto exchange FTX has been authorized to sell trust assets valued at around $873 million.

The proceeds from the sale will be used to repay creditors affected by the exchange’s collapse in 2022.

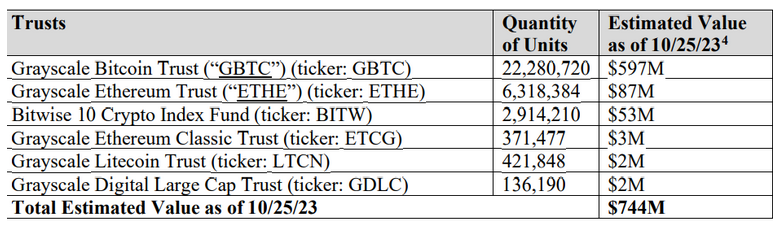

Assets amounting to $873 million will be acquired through FTX’s investments in trusts issued by crypto asset manager Grayscale Investments, valued at $807 million, and custody service provider Bitwise — valued at $66 million.

The court document mentions a total of $744 million in assets; however, this value is only accurate as of Oct. 25, 2023.

Since then, the assets have appreciated in value.

The authorization was granted roughly four weeks after FTX debtors presented a motion to Judge John Dorsey on Nov. 3, petitioning for the liquidation of six cryptocurrency trusts, such as the Grayscale Bitcoin Trust (GBTC), Grayscale Ethereum Trust (ETHE), and Bitwise 10 Crypto Index Fund (BITW).

Over 22 million units of GBTC, Grayscale’s primary Bitcoin product, are currently held by FTX for $691 million, while 6.3 million shares of ETHE are valued at approximately $106 million.

However, FTX can now sell three additional trusts—Digital Large Cap Trust (GDLC), Litecoin Trust (LTCN), and Ethereum Classic Trust (ETCG)—managed by Grayscale—in order to recover funds for affected FTX customers.

FTX’s Administrators, led by John. J. Ray III has attempted to recover assets since November 2022, when Sam Bankman-Fried’s former empire collapsed.

However, around $7 billion in assets have been recovered thus far, of which nearly $3.4 billion is in the form of cryptocurrencies.

In June, FTX’s debtors approximated that the overall value of misappropriated customer assets amounted to $8.7 billion.

Meanwhile, Bankman-Fried, who was found guilty on seven counts of fraud on Nov. 2, will receive his sentence on March 28.

Presently, he is confined to the Metropolitan Detention Center in Brooklyn, where he paid four mackerels in exchange for a trim.