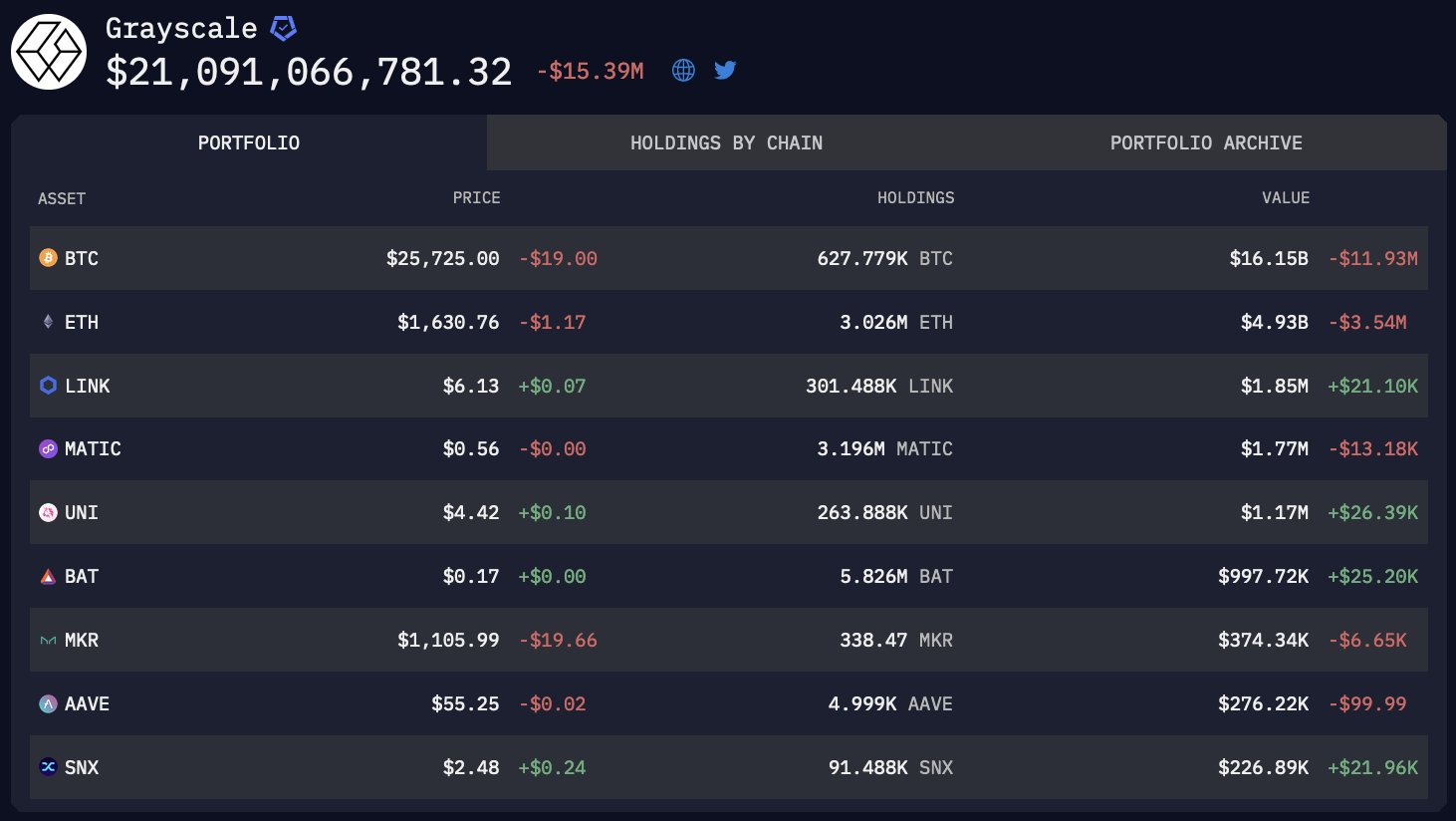

Following their publicly disclosed findings on X (formerly known as Twitter) on September 6th, it has been established that GBTC encompasses a collective total of more than 1,750 addresses, jointly holding a sum exceeding $16 billion in Bitcoin.

This disclosure affirms the company’s prominent standing within the cryptocurrency sphere.

Despite Grayscale’s efforts to maintain the confidentiality of the on-chain addresses associated with their trust, Arkham Intelligence successfully unveiled the allocation of funds across these addresses, each containing 1,000 BTC or less.

This information is substantiated by the official website, which reports the overall assets of the BTC trust at $16.009 billion.

Currently, the Grayscale Bitcoin Trust is embroiled in a legal dispute with the U.S. Securities and Exchange Commission (SEC) as it endeavors to transition into an exchange-traded fund (ETF).

This strategic move underscores the company’s ongoing commitment to adapting to the evolving regulatory landscape that encompasses cryptocurrencies.

It is noteworthy that Arkham Intelligence had previously identified 500 cryptocurrency wallets linked to the Grayscale Ethereum Trust, positioning it as the second-largest Ethereum entity globally, with assets under management (AUM) amounting to $4.9 billion.

The trust trades at a 30% discount relative to its net asset value (NAV), a notable reduction from the 55% discount observed in June.

Arkham Intelligence’s research has also unveiled Robinhood as the holder of the third-largest Bitcoin wallet and the fifth-largest Ethereum wallet.

Grayscale has faced scrutiny regarding the transparency of its Bitcoin holdings, but its custodial partner, Coinbase, later issued a comprehensive report addressing these concerns.

Investors increasingly seek regulated and secure financial products as the cryptocurrency market continues expanding.

This trend has contributed to the ascent of entities like Grayscale and has spurred discussions surrounding ETFs within the industry.