DAI’s decentralized autonomous organization (DAO), MakerDAO, has selected Dollar Coin as its primary collateral. An alternative plan to “diversify” collateral into Gemini U.S. Dollar (GUSD) and U.S. Dollar Paxos (USDP) was rejected by 20% to 79%, according to the proposal’s website.

The MakerDAO Risk Core Unit recommended on March 17 that government actions had reduced the risk of a U.S. bank run. Hence, utilizing USDC as collateral “has reduced considerably since last week, and we do not foresee any additional solvency issues or depegs at this moment.”

Nonetheless, it warned of risks. USDC has “possibly more dangerous exposure to uninsured bank deposits” and “a weaker legal framework” than its rivals, GUSD and USDP, according to the proposal.

The Risk Core Unit proposed two ways to “normalize” DAI minting restrictions after the crisis. USDC, GUSD, and USDP minting capacity limitations were initially considered. If this option were chosen, the USDC to DAI conversion charge would drop from 1% to 0.05% instantly but not to zero until later.

The Risk Core Unit says this first alternative would “more equally distribute Maker PSM stablecoin reserves among several assets,” lowering USDC depeg risk.

Second, raise USDC to DAI minting capacity from 250 million to 450 million and lower the charge to zero percent. DAI would “continue to have disproportionate exposure to USDC” if DAI minting restrictions were “closer to their prior condition,” according to the research.

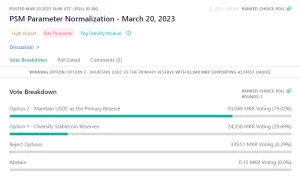

MKR holders preferred the second alternative (78.02% to 20.69%). 0.29% of MKR voters rejected both selections, while 0.15 (nearly 0%) abstained.

After a wave of bank failures on March 11, the USDC stablecoin temporarily dipped below $0.90. MakerDAO took great measures to prevent arbitrageurs from dumping coins into the network and undercollateralizing DAI.

The daily minting ceiling was reduced from 950 million DAI to 250 million, while the USDC collateral fee was raised from 0% to 1%.

USDC reached $0.9987 on March 13, regaining $1 parity. On March 23, the special measures remained in place.