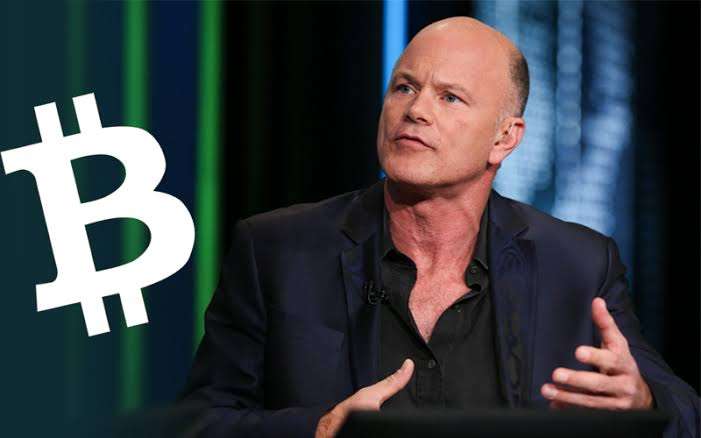

Michael Novogratz, CEO of Galaxy Digital, discussed the present state of the cryptocurrency market, emphasizing Bitcoin, in a recent CNBC interview.

Novogratz observed a remarkable 150% appreciation in the value of Bitcoin during the previous year, ascribing this upswing to the dovish position adopted by the Federal Reserve.

The speaker underscored the pivotal significance of the Central Bank in shaping market trends encompassing a wide range of asset classes, such as equities and fixed income.

Regarding Bitcoin Exchange-Traded Funds (ETFs), Novogratz conveyed assurance regarding the timely authorization of spot Bitcoin ETFs before January 10th.

He emphasized the importance of this date on account of possible legal ramifications. He predicted that such approval would provide additional impetus to the Bitcoin and cryptocurrency markets, which were already thriving.

Notwithstanding his sanguine outlook, Novogratz duly recognized certain apprehensions, specifically concerning the conduct of high-risk speculative traders, colloquially referred to as “de-gens” or degenerates.

It is believed that these speculators are responsible for the significant volatility observed in the cryptocurrency market.

In response to whether Bitcoin should be categorized as a “haven” or a “speculative asset,” Novogratz emphasized the worldwide reach of Bitcoin

. He refuted apprehensions regarding its unauthorized applications, asserting that the myth that cryptocurrencies are predominantly utilized to finance terrorism has been disproven.

He contrasted the relatively low incidence of fraudulent cryptocurrency usage with the substantial penalties suffered by conventional financial institutions, including JPMorgan.

Concerning the future, Novogratz maintained an optimistic stance towards Bitcoin. Due to its limited supply, he suggested that even a modest 1% allocation of institutional portfolios to Bitcoin could considerably increase its price.

He predicted that Bitcoin would ascend to unprecedented heights in the coming year, surpassing its all-time high of $69,000.

Regarding regulation, Novogratz noted that specific corporate leaders and legislators, such as Elizabeth Warren and the Biden White House, have impeded legislative advancements in the cryptocurrency space.

A bipartisan organization that could provide a solid foundation for stablecoins and the broader cryptocurrency market was cited. However, he suggested that significant advancements might be postponed until after the forthcoming election.

In essence, Novogratz’s statements emphasize a pervasive sense of optimism concerning the trajectory of Bitcoin and the wider cryptocurrency industry.

As catalysts for additional market gains, he identifies the Federal Reserve’s dovish stance, the possibility of ETF approval, and increasing institutional interest. However, he recognizes that regulatory clarity is essential for long-term, sustained development.