Following the Shapella upgrade this week, Ether prices have surpassed the psychological $2,000 threshold, resulting in a decline in Bitcoin’s market dominance.

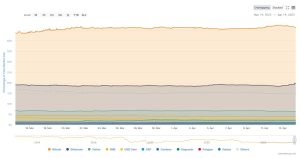

According to data from the analysis website btctools.io, Ether’s market share rose to 19.8%, an increase of over 1.1%, in the 24 hours before the time of writing on April 14, while Bitcoin’s dominance declined by less than 1%. Since the beginning of the year, ETH has gained 7.6% of the market share.

Ethereum’s market share has increased while Bitcoin’s has decreased to 47.7%. The post-Shapella ETH rally has reduced BTC’s market share to levels not seen in nearly two years.

BTC’s market share reached 48.8% on April 12 as a result of its rally to $30,000, the greatest level since July 2021, when it approached 50%. Since April 2021, BTC has not been more than 50% dominant.

According to TradingView data, Bitcoin’s dominance has increased by 13.6% since the start of the year.

Both BTC and ETH have gained market share at the expense of Altcoins, the majority of which have been underwhelming during the recent rally of the two leading coins.

Bitcoin and Ether represent approximately 68% of the total cryptocurrency market. Stablecoins account for roughly 10% of the market, meaning the other 10,800 or so tokens listed on the price analytics platform CoinGecko have a combined 22% market share.

The market dominance of an asset is determined by comparing its market capitalization to the total crypto market capitalization, which is presently at an 11-month high of $1.33 trillion.

The price of ETH has increased by 10.25% over the past 24 hours. According to data, the asset reached an 11-month peak of $2,122 during the 14 April morning Asian trading session.

A successful Shapella upgrade on April 12 that released staked ETH on the Beacon Chain has propelled the price of Ether.