The Central Bank of Singapore has issued nine-year prohibition orders to Kyle Davies and Su Zhu for alleged violations of the country’s securities laws at the crypto hedge fund they co-founded, Three Arrows Capital (3AC).

In a statement released on September 14, the Monetary Authority of Singapore (MAS) stated that Zhu and Davies are prohibited from engaging in regulated activities for the duration of the 13-day prohibition period.

Additionally, they will not be permitted to manage, function as a director, or be a significant shareholder in any Singaporean capital market services business.

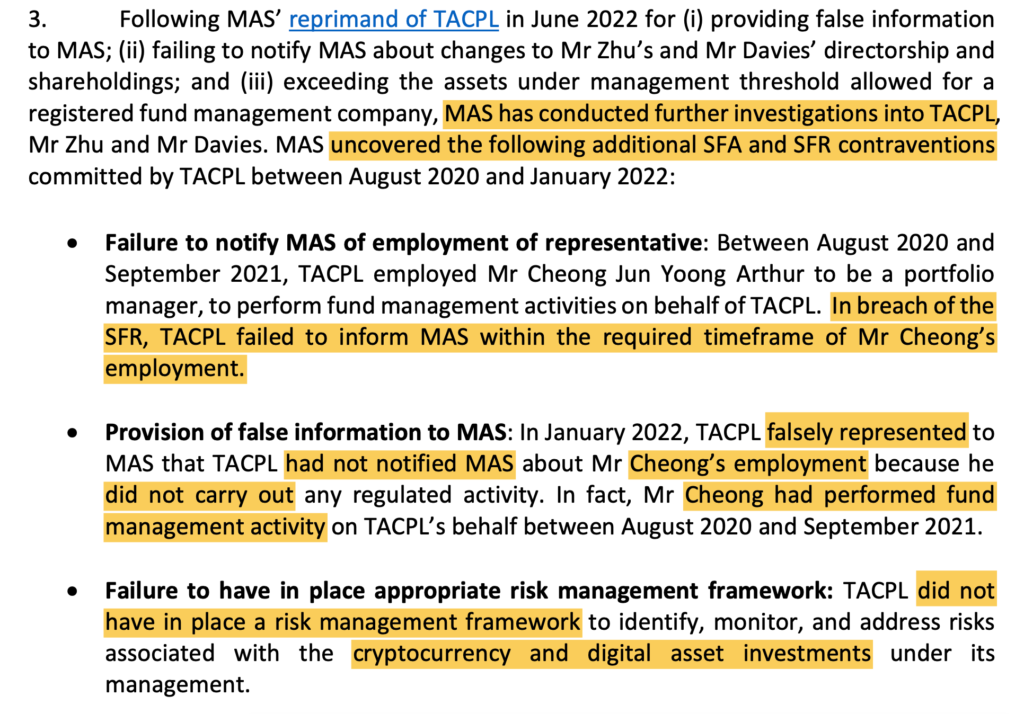

Upon further investigation of the bankrupt 3AC and its co-founders, MAS discovered additional securities law violations, which led to its decision to bar the duo.

MAS asserted that Su and Davies neglected to notify the central bank that 3AC had hired a new business representative, provided false information to the regulator, and lacked an adequate risk management framework.

MAS’s assistant managing director of policy, payments, and financial crime, Loo Siew Yee, stated, “MAS takes Mr. Zhu and Mr. Davies’ flagrant disregard for MAS’ regulatory requirements and dereliction of duty as directors very seriously.” She continued, “MAS will eliminate senior managers who engage in such misconduct.”

Last June, MAS reprimanded the hedge fund for providing it with deceptive information, not informing it of Zhu’s and Davies’ directorship changes, and exceeding the legal threshold for assets under management.

This occurred amid widespread reports of insolvency and one day before 3AC filed for bankruptcy. 3AC was wiped out in last year’s crypto market crisis, which was precipitated by the collapse of the Terra ecosystem, as its leveraged crypto positions exposed it to billions of dollars in loan defaults.

Creditors assert that 3AC owes up to $3.5 billion, and liquidators are attempting to collect approximately $1.3 billion from Zhu and Davies, who allegedly incurred the debt while the company was already insolvent.