Tokenization of US Treasurys saw a remarkable surge in 2023, experiencing a growth of 641%, reaching a market value of $845m by the year’s end.

According to the digital asset data tracker CoinGecko, tokenized US Treasury experienced a growth surge of 641% in 2023.

This increased growth occurred due to traditional banking institutions joining the tokenization movement. CoinGecko published the research “Rise of Real World Assets in Crypto” on March 21st, 2024.

The report underscores the advancements in the tokenization of real-world assets (RWA). According to CoinGecko, the value of tokenized US Treasurys increased from $114 million in January 2023 to $845 million at the end of 2023.

The data presented here demonstrates that blockchain-based digital tokens representing US Treasury securities experienced a growth of 641% in just one year.

A real-world asset (RWA), like a stock or bond, backs a digital token known as a tokenized security. For instance, the Ondo Short-Term US Government Bond Fund uses the OUSG token to represent ownership of a share and its yield.

In a recent article, CoinGecko highlighted that Franklin Templeton, an asset management firm, is currently the top issuer of tokenized US Treasury debt. The corporation has distributed tokens valued at $332 million through its On-Chain U.S. Government Money Fund, responsible for 38.6% of the markets.

In January, Franklin Templeton was one of the ten exchange-traded fund (ETF) issuers that announced the introduction of a spot Bitcoin ETF throughout the United States.

On February 12, it applied to the United States Securities and Exchange Commission, indicating that it is also competing to create an Ethereum exchange-traded fund (ETF).

Other protocols that provide yield-bearing stablecoins backed by U.S. Treasury bills are also gaining popularity. Franklin Templeton is one of these protocols.

CoinGecko’s research reveals that since the cryptocurrency’s inception in September 2023, the value of Mountain Protocol’s USDM tokens has increased from $26,000 to $154 million.The Ethereum network is the primary foundation for tokenized United States Treasury bills.

In the report, CoinGecko mentioned that Ethereum is the platform where 57.5% of the tokens are located. In the meantime, businesses such as Franklin Templeton and WisdomTree Prime have issued tokenized assets on Stellar, which has resulted in 39 percent of the market being held by the network.

US Treasury Growth Slows in 2024

In 2023, tokenized treasuries experienced explosive expansion; however, in 2024, this growth tapered down. Tokenized treasuries only experienced a growth rate of 1.9% in January 2024. Estimates place their market value at $861 million as of the first of February.

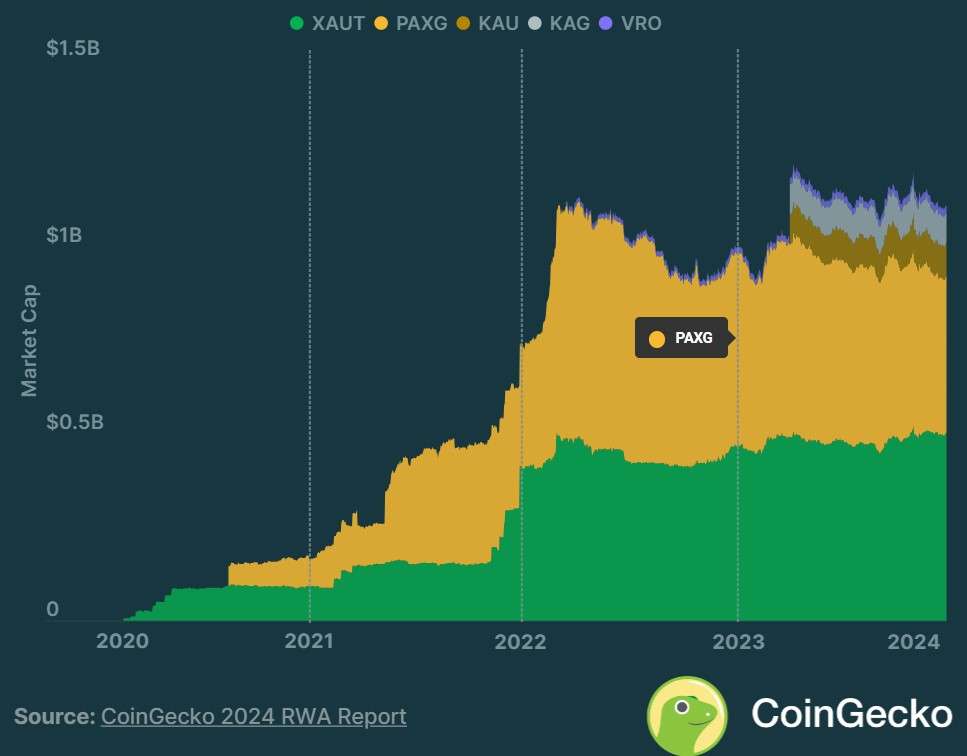

As of February 1, CoinGecko reported that commodity-backed tokens have already reached a market valuation of $1.1 billion. This is in addition to tokenized treasuries that have previously reached this level.

Tether Gold (XAUT) and PAX Gold (PAXG) currently hold tokenized precious metals, accounting for 83% of the market capitalization.In addition, a new project has begun the process of tokenizing uranium, enabling the process of redeeming the precious metal with digital tokens.